Connecticut’s major tax increases in 2009, 2011 and 2015 may have offered the state temporary budget relief, but in the end Connecticut appears to be a little worse off than the rest of the country.

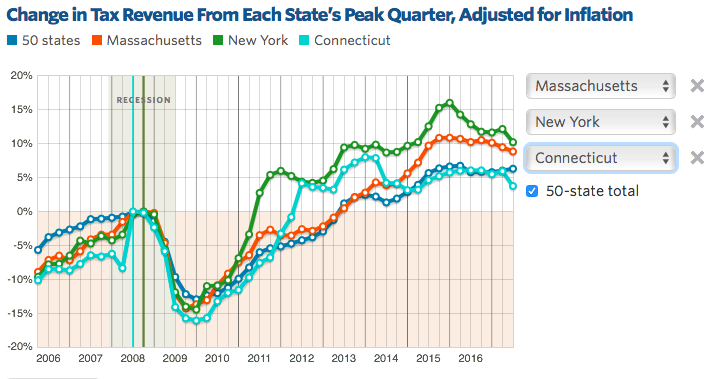

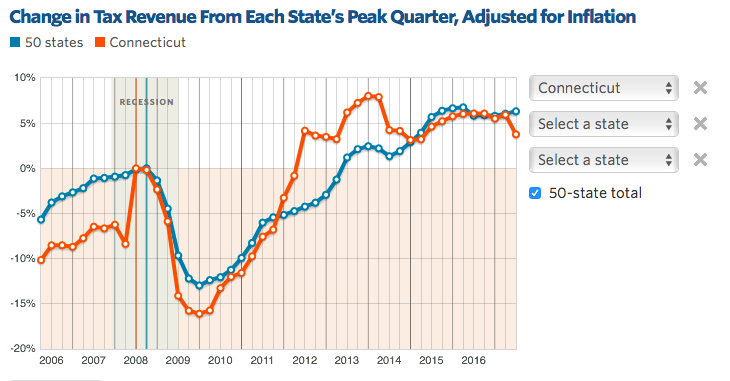

According to information compiled by Pew Charitable Trusts, tax revenue for all 50 states is — on average — 6.3 percent higher than it was at the start of the 2008 recession.

Connecticut tax revenue, on the other hand, is only 3.8 percent higher, despite tax increases three tax increases, which have driven up the cost of living in Connecticut.

Connecticut was hard-hit by the recession due to its strong reliance on tax revenue from the financial services sector, but it seems the state may have overcompensated.

In 2009, Connecticut added another 6.5 percent income tax bracket for those earning over $500,000 per year.

Connecticut the followed up with a more comprehensive $1.5 billion tax increase in 2011, which affected all economic sectors to deal with a budget shortfall.

“As officials in nearby states — including New York, New Jersey and Massachusetts — have become conspicuous converts to the current antitax, antigovernment fever, Mr. Malloy and Connecticut Democrats are striking a more anomalous course, betting that residents will accept the short-term pain of tax increases if they see a long-term gain of stable government services and fiscal policy.”

“Bucking Trend, Connecticut Budget Deal Raises Taxes, Gasoline Excepted.” New York Times, 5/2/2011

Although Connecticut recovered lost tax revenue faster than the average state, the revenue leveled off and began to drop in 2014. The last round of tax increases in 2015 created only a modest rise in revenue.

Connecticut has struggled since the recession and is the only state in the nation which has yet to recover the jobs lost during the economic downturn.

In addition, the state has seen an outmigration of residents since 2013 and the loss of a few major financial investors.

Data from the Internal Revenue Service showed a spike in residents earning over $200,000 per year leaving the state in 2015 and studies conducted by Connecticut state agencies and commissions have confirmed the loss of higher income residents to other states.

The slow-down in tax revenue has put severe strain on Connecticut’s budget process. Lower-than-expected revenue in 2017 caused the budget deficit to jump from $3.6 billion to more than $5 billion, leading to a long, drawn out budget battle in the legislature.

But the flat and declining revenue has been met with fast-paced growth of Connecticut’s fixed costs — Medicaid, pensions, retiree healthcare and debt service — which now consume nearly 50 percent of the General Fund budget.

Fixed costs have grown significantly since 2000, when they comprised 35 percent of the General Fund budget.

Both New York and Massachusetts have fully bounced back from the recession in terms of job growth and tax revenue. Massachusetts has recovered over 300 percent of the jobs lost during the 2008 recession has now seen 8.9 percent revenue growth, while New York revenue has increased 10.2 percent.