Connecticut is projected to see higher than average home sales during the third quarter of 2018, according to ATTOM Data Solutions, and most of the activity is in Fairfield and New Haven Counties.

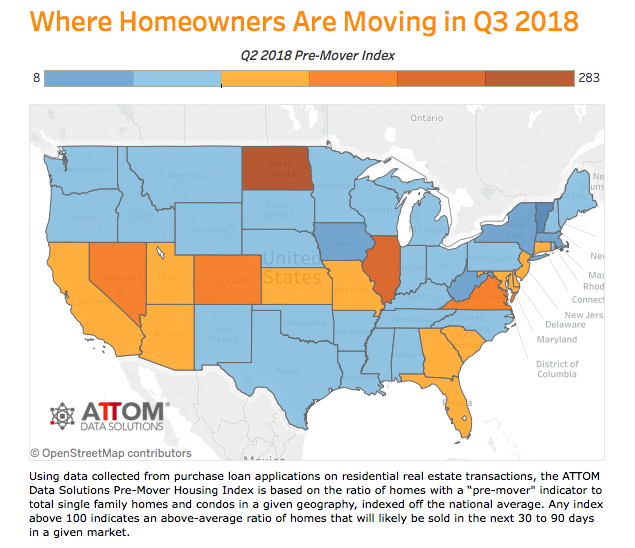

ATTOM gathered data from purchase loan applications and “good faith estimates” to analyze the number of homes likely to be sold in a given area. Connecticut was one of 17 states listed as above the national average score of 100.

Connecticut scored a 118 overall, but Fairfield and New Haven counties scored a 156, meaning most of the state’s home sales in the third quarter will be in those areas.

That could either bode well for Connecticut or be a precursor for yet another year in which the state sees a population decline as residents move to other states.

Darren Blomquist of ATTOM says it is impossible to know whether people are moving into or out of the area based on the data alone.

“We don’t where the people moving in are coming from or where the people moving out are going to, but we’re identifying the areas that will have high turnover in the next 90 days,” Blomquist said.

Blomquist notes, however, that states with high migration trends have a higher pre-mover index. Nevada has a lot of people moving into the state and scored a 164, while Illinois has a high outmigration pattern and scored a 196.

Connecticut experienced a net loss of residents every year between 2013 and 2017. Connecticut ranked fourth in the country for people moving out in 2017, but international immigration kept Connecticut’s population flat in 2017.

Historically, both Fairfield and New Haven counties have been the population engines for Connecticut, gaining residents even as the overall state population declined.

But changes in the federal government’s tax code could throw gasoline on Connecticut’s smoldering outmigration problem, capping local property tax deductions at $10,000 and capping the mortgage interest deductions for loans at $750,000.

The average estimated value of homes for sale in the Connecticut is $345,925, according to ATTOM’s data, a year-over-year increase of 38 percent. That could mean it’s a seller’s market; more worrisomely, it could also mean more high value houses are being put up for sale.

However, in Fairfield County, the average estimated property value is $521,346 for properties projected to sell in the third quarter of 2018.

The average Fairfield County property tax was $10,612, according to ATTOM’s analysis of property tax data in 2017, the 8th highest of the 1,414 areas they analyzed.

Michael Barbaro, president of the Connecticut Realtors Association, says the loss of the deduction will have a “negative impact” on Connecticut and is concerned that Connecticut’s continuing fiscal problems will trickle down to municipalities, driving property taxes higher in a state which already has a hefty tax burden.

“My experience is we have more people interested in moving out because of the SALT deduction,” Barbaro said. “The state can’t get its fiscal house in order and now they’re losing the deduction, this just further exacerbates the negative impact in state’s like Connecticut.”

The Connecticut legislature attempted to bypass the federal tax changes by allowing municipalities to create “charitable organizations” to which homeowners could make “contributions,” but the IRS has moved to block the workaround.

“This is speculative, but one thing we know that’s going on is the tax reform legislation that took effect at the beginning of this year,” Blomquist said. “One theory has been – and there are some early signs of this — that we will see some weakness in some of the higher-end markets, particularly those that have high property taxes because people can’t take the full deduction they used to.”

Connecticut’s outmigration trend has cost the state in revenue as higher income residents have left and been replaced by those making on average $30,000 less per year, according to a report by the Commission on Fiscal Stability and Economic Growth.

Connecticut’s outmigration among its wealthiest residents spiked in 2015, coinciding with the state’s last major tax increase. The largest group of tax filers leaving the state earned over $200,000 per year, according to the Internal Revenue Service.

Meanwhile, Connecticut has seen the slowest increase in home values in the country between 2012 and 2017.

Barbaro says that markets like Fairfield County and New Haven County get a lot of “lateral movement” from neighboring New York, but he is not seeing people moving into the state from lower tax states.

According to Barbaro, Yale University is a big draw, particularly the hospital, as aspiring doctors move into the greater New Haven area to complete their residency. But some of those new residents ask him whether they will be able to sell their home in three years when their residency is complete.

“It’s a shame,” Barbaro said. “They’re going to take their skills and go someplace else.”

Blomquist notes that ATTOM’s figures do not include all properties for sale in Connecticut, only those with “pre-mover flags,” which have a strong correlation to actual home sales within 90 days.