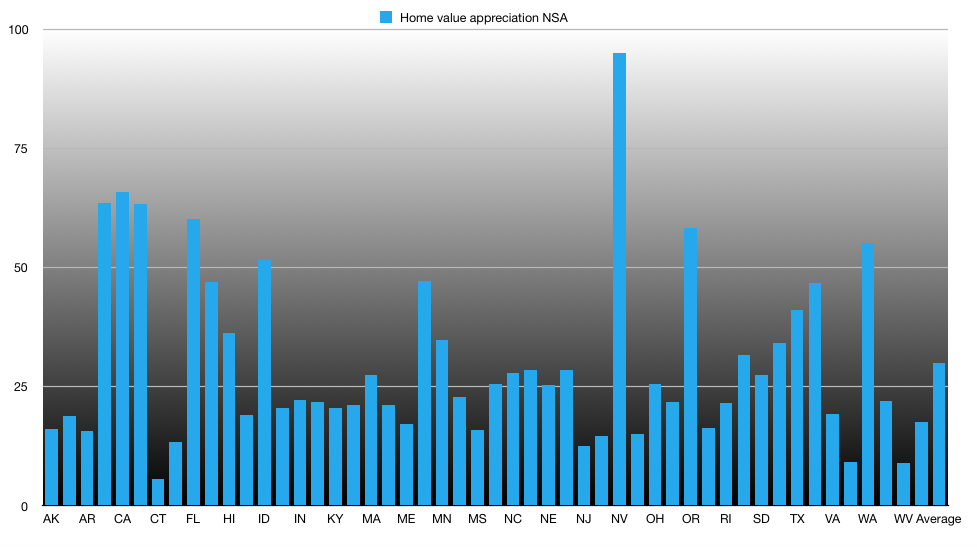

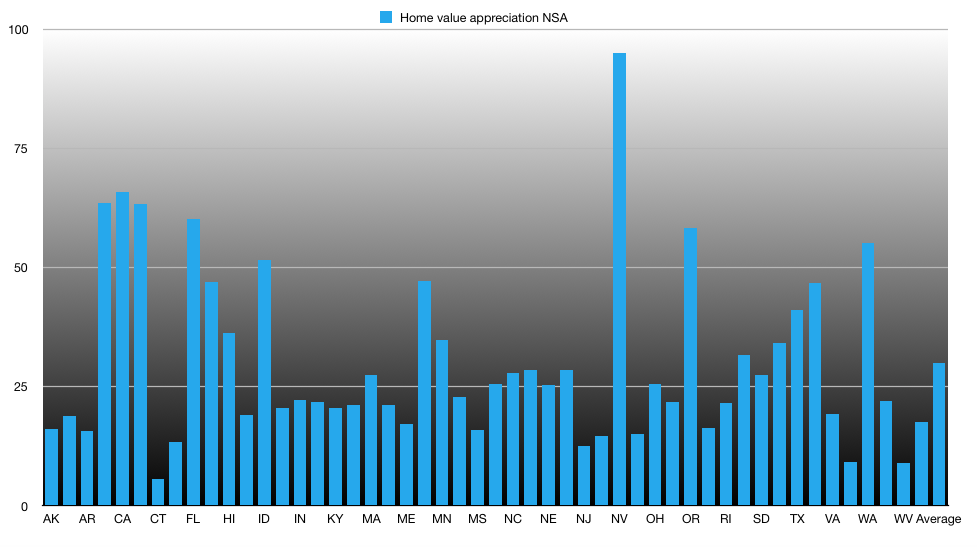

Connecticut’s Housing Price Index saw the lowest growth in the nation between 2012 and 2017, according to a review of figures from the Federal Housing Finance Agency.

Connecticut’s HPI grew 5.5 percent over the course of five years, far lower than the national average of 30 percent and well below other states in the Northeast. Massachusetts grew by 27 percent, while New York grew by 15 percent.

The struggling state of West Virginia saw the second-slowest growth in HPI of 8.3 percent. Nevada saw, by far, the highest home value growth in the country.

The Housing Price Index is a “broad measure of the movement of single-family house prices in the United States,” according to the FHFA and the numbers do not look good for Connecticut.

President and CEO of Connecticut REALTORS Michael Barbaro says these figures “are in line with what we’ve seen.”

Connecticut’s housing market is “defying the laws of economics,” Barbaro said in an interview. “We have low inventory and flat prices. Normally, with low inventory we should have high prices.”

Barbaro believes that many people who purchased homes before the housing market crash and recession of 2008 may still be underwater on their mortgages and can’t afford to get out from under their current houses.

“A lot of houses are priced high and sitting on the market a long time,” Barbaro said. “That might mean people can’t afford to buy out of their mortgages.” Barbaro also says they haven’t seen a lot of people upgrading to larger homes.

“I think Connecticut is still feeling the effects of the recession and the housing market crash. We just haven’t come back from it yet,” Barbaro said.

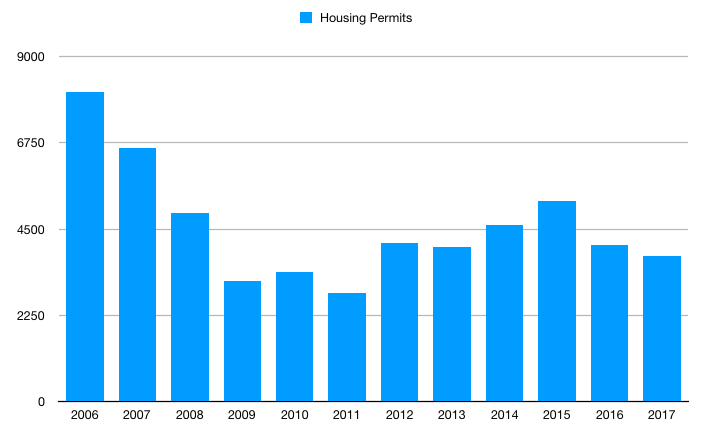

Permits for new houses remained relatively flat over those five years with 300 less permits being granted for new houses, according to the Connecticut Department of Economic and Community Development. But the numbers are half of what they were before the housing market crash.

Economically, Connecticut has been one of the slowest states in the nation to recover from the economic shock of the 2008 recession. The state has yet to recover all the jobs lost during that time and personal income growth is far below the national average.

Concurrently, the state has seen a pronounced loss of residents to other states in the last three to five years.

Donald Klepper-Smith, former economic adviser to Gov. M. Jodi Rell and chief economist for DataCore Partners, LLC, says a struggling real estate market comes as “no surprise” given Connecticut’s economic situation.

“The health of the local labor markets and local housing market go hand and hand in the long run,” Klepper-Smith said in an email. “Meaning traction in the local jobs picture often translates into increased demand for housing and rising home values.”

Klepper-Smith noted that Connecticut’s .1 percent job growth over the past year has coincided with a 1.5 percent increase in the median home value for Connecticut compared with Massachusetts where median home values increased 7 percent during the same time.

To date, Massachusetts has recovered more than 300 percent of the jobs lost during the 2008 recession.

Connecticut is one of the few states losing population, according to a number of U.S. Census Bureau reports and the annual National Movers Study.

Numbers from the Internal Revenue Service showed that in 2015 the largest group of individuals leaving the state earned over $200,000 annually, all of which puts a strain on home values.

Diddly McSkrickles

July 10, 2018 @ 4:38 pm

It struggles because of high property taxes that suffocate affordability to assessed prices. When you have a 5-6 effective market value tax rate of the value of your home PER YEAR on middle class housing 20-300k range of homes, not only is it more difficult to get a mortgage, as those tax rates suffocate income allotted for bills, groceries, or keeping and maintaining a home over time, it doesn’t take a genius to figure that out. No one wants to pay for a 200k 1000-1700 sq ft home that hasn’t seen updates since the 1960s lol… It ain’t gonna happen. Every service and utility in CT is exponentially higher, and for no other reason than “because”. In the 21st century, there’s no excuse for all the archaic, expensive, and caustic red tape and regulations for building among others. Democrat and Republican fund milking policies need to end. Public employees need to manage their own retirements like everyone else.

LEX T

July 11, 2018 @ 7:39 am

As a family that just left CT after four years, I can without hesitation say that CT is the worst place to attempt to raise a family. Why? Anything to do with the administration of tax dollars has been corrupted in favor of the public employee’s self interest over the well being of the populace. Google “corrupticut” to see what I mean. Obviously, if the state has systemic problems with politicians and law enforcement, coupled with bad weather, no pro sports teams, a very high cost of living (they’re talking about toll roads now as a new tax) and generally miserable people in society-no educated person with options/skills would raise a family there. Also, as far as actual housing values go, a renegade cement company from Stafford Springs CT poured 1000’s of faulty foundations over the decades, erasing the value of much of the real estate market, especially in NE CT.

gary

August 30, 2018 @ 2:27 pm

40 years of Public sector unions doing their job of influencing politicians and fooling the voter is now taking its toll. The future for Ct is bleak. Many of the pensions and benefit plans are not even funded and the salaries including benefits for public sector employees are 1 1/2 to 2 times as much as workers with the same skills and education in the private sector. The public sector unions own the democrat party and intimidate the replublican party. The next 20 years will be impossible. People with any money (especially retired public sector employees), are moving out. See Puerto Rico.

Cindy Keegan

September 1, 2018 @ 11:03 am

I am a lifelong resident of Connecticut and love the life I have enjoyed here. This November we will have the opportunity to elect a new governor. I pray our new leadership will have the courage to make the changes needed to get CT back on track. My fear is that another democrat will be elected and continue the past practice of poor financial management. I understand why many hard working residents feel like the only solution is to abandon ship.

Ed Case

October 5, 2018 @ 10:20 am

The fact of the matter is that the chickens are coming home to roost. Zero growth in new businesses that attract workers that can afford to buy property. Taxing people out of their homes. Failure to help people retain homes they bought after they lost jobs etc, The axe is bound to hit because we have been living beyond our means as DEBT SLAVES caused directly by the Federal Reserve practices. The system needs to change radically. Gad made all people equal. The dollar made all people grossly unequal. Time to redistribute wealth or get rid of the monetary system, or turn over all of the monetary system to the people who deserve it and not the 1% who have abused it over the centuries stuffing their fat accounts while letting others suffer for no good reason.

Ginger Duprey

October 12, 2018 @ 3:58 pm

I would like to retire but living in Ct. makes it impossible.

I have my house on the market and leaving the State of Connecticut!

Looking forward to moving to a State without the burden of

high taxes and utilities.

This is the reality meaning TRUTH.

Robert Paltauf

October 26, 2018 @ 5:27 pm

Its always greener on the other side, and it really is ! These taxes and high cost of living are why people want to leave. How is it possible that in NC a home property taxes are about 1,000. per year yet mine are 20K we both have schools and roads it drives me nuts with the unaccountability in spending in this state.

Eric

October 27, 2018 @ 7:45 pm

What’s broken in CT? The political leadership. Malloy has literally obliterated this place – home values are just one result of financial mismanagement. If this state doesn’t elect Republican leadership to get this mess fixed, it’s likely to get A LOT worse. If a recession hits, and it likely will in another year (we’re about due), it’s going to compound the situation.

Democrats only understand raising taxes and driving out businesses and people. The biggest group LEAVING is that “above $200k” income… And guess who carries the lion’s share of the costs? Only Democrat leadership could oversee a state and run it into the ground while the rest of the country has been BOOMING.

Wise up, CT.

Andrew Morosky

March 14, 2019 @ 11:23 pm

Republicans have shown they have no fiscal sense whatsoever with their Tax Scam of 2018. They are not the answer to Connecticut’s woes.

Ami Sy

October 31, 2018 @ 1:43 am

Finally a platform where I can share my sadness and frustration about CT. We are among the ppl who left in 2015! Owned a business that relied on the ppl and business that left CT. My only choice was to leave too. The sad part is we invested all our retirement on real-estate 3 houses all under water. Can’t sell, taxes are going up none care, high income families left, business are closing no official care. Even Detroit recovered from the recession. I live in Colorado where home are in the market for 1 day and bought over bid war. Dang! You ‘ll think you are in a different United States!

What happens in CT is so heart breaking that I don’t know how we took all we had and bought houses in this state! I would be a millionaire if these home were in Colorado or Virginia. The housing market is so uncertain we do not know when we will sell these overtaxed undervalued home!

I think Democrat and Republican ruin the state! Did you forgot Rowland was the first to steali from from the state then Jodi Rell didn’t do nothing and Malloy too

To all the officials you don’t have to reinvent Connecticut but you can just COPY the positive example of economic development MODEL of successful States do to stay welcoming and compétitive. Utilities are affordable anywhere in the nation and ridiculously expensive in CT.

NYkera prefer buying in New Jersey than hour cheap homes fallling market. That’s a shame! All well educated and big employers left the state over high taxes. Very frustrating

Robert

December 10, 2018 @ 5:21 pm

My wife and I tried raising our family in Fairfield County from ’04-’16. The cost of living was insane, and it seemed that we were surrounded by investment bankers, which also seemed to drive up the cost of living. It’s good if you are pulling down 500K per year, but we sure weren’t. We threw in the towel and moved to the midwest. We have been renting out our house in CT since then because nobody wanted to buy it, at pretty much any price. It wasn’t underwater, on paper at least. But if you can’t get rid of it, it might as well be. We have much better career opportunities out here. Thinking about CT is just so bittersweet. It was such a pretty place to live, and I do miss it. But, in the end, there was just nothing for us there anymore.

Rcihard condon

August 4, 2019 @ 9:50 am

No one here mentions the luck of the draw. Blame pols and spending all you want. this is happening everywhere and creates Trumps ! Red states with low taxes have no services. All must educate their kids at $9 K per year each. If you pay lower taxes you wind up in place like Florida where you can’t drink the waterer swim in it. Time to look at a political system that’s run by business and change that.